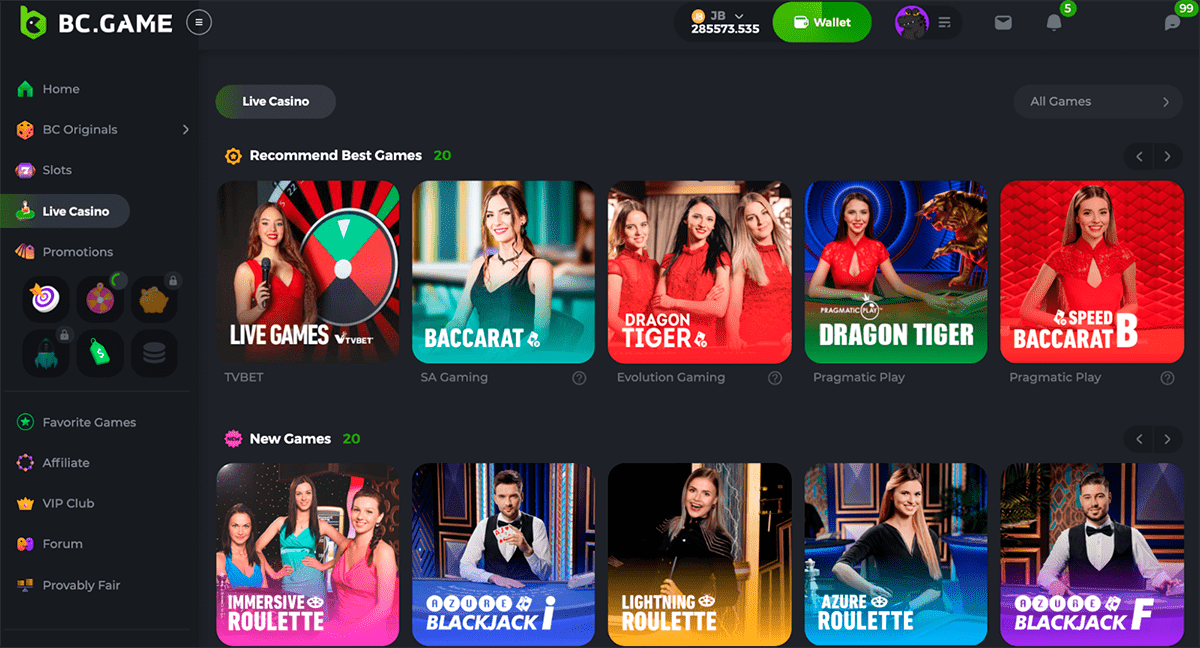

Ingin tahu tentang bocoran RTP slot terbaik dan terbaru hari ini? Jika Anda adalah penggemar permainan RTP slot dan ingin mencari tahu tentang keberuntungan RTP terbaru, maka Anda berada di tempat yang tepat. Dalam artikel ini, kami akan mengungkap bocoran terkini mengenai RTP slot dan RTP live yang akan membuat Anda semakin bersemangat untuk mencoba peruntungan Anda.

RTP, atau Return to Player, adalah persentase kemenangan yang dapat Anda harapkan dari suatu permainan slot. Semakin tinggi nilai RTP, semakin tinggi pula peluang Anda untuk memenangkan hadiah besar. Dalam artikel ini, kami akan membahas beberapa bocoran RTP slot terbaik dan tertinggi hari ini, sehingga Anda bisa mengatur strategi permainan Anda dengan bijak.

Tak hanya itu, kami juga akan memberikan bocoran mengenai RTP live slot gacor yang sedang populer saat ini. RTP live slot merupakan variasi permainan yang menawarkan keseruan langsung dari studio permainan dengan dealer sungguhan. Dalam artikel ini, Anda akan menemukan bocoran terkini mengenai RTP live hari ini, sehingga Anda dapat merencanakan permainan Anda dengan lebih baik.

Dengan informasi terkini mengenai bocoran RTP slot terbaik, RTP live slot gacor, dan bocoran RTP live hari ini, Anda akan memiliki keunggulan yang lebih besar untuk mengejar jackpot besar dalam permainan slot favorit Anda. Jadi, tetaplah bersama kami dan dapatkan informasi terkini yang akan membantu Anda meraih kemenangan yang menggiurkan. Selamat bermain dan semoga beruntung!

RTP Slot Terbaik Hari Ini

Slot permainan memiliki beragam variasi yang menyenangkan dan menarik bagi para pecinta judi online. https://ourschoolsnow.com/ Salah satu faktor penting dalam memilih dan bermain slot adalah tingkat RTP (Return to Player) yang dimiliki oleh permainan tersebut. RTP adalah persentase pembayaran yang bisa Anda harapkan dalam jangka panjang. Di dalam artikel ini, kami akan memberikan daftar slot terbaik hari ini berdasarkan tingkat RTP mereka.

Slot pertama yang masuk dalam daftar slot terbaik hari ini adalah [Judul Slot 1]. Game ini memiliki tingkat RTP yang sangat tinggi, mencapai [tingkat RTP]. Dengan persentase pembayaran yang tinggi, Anda memiliki peluang yang lebih baik untuk mendapatkan kemenangan dan memaksimalkan keuntungan Anda.

Selanjutnya, [Judul Slot 2] adalah slot lainnya yang patut dicoba. Slot ini terkenal karena tingkat RTP-nya yang tinggi, mencapai [tingkat RTP]. Dengan grafis yang menarik dan gameplay yang menyenangkan, [Judul Slot 2] akan memberikan pengalaman bermain yang menghibur sekaligus peluang untuk meraih kemenangan yang besar.

Terakhir, [Judul Slot 3] merupakan slot dengan tingkat RTP tertinggi hari ini. Tingkat RTP-nya mencapai [tingkat RTP], memberikan kesempatan yang luar biasa bagi pemain untuk mendapatkan pembayaran yang menggiurkan. Dengan bermain [Judul Slot 3], Anda memiliki peluang lebih baik untuk meraih kemenangan besar dan mengakhiri hari ini dengan senyum.

Itulah daftar slot terbaik hari ini berdasarkan tingkat RTP mereka. Jangan ragu untuk mencoba permainan-permainan tersebut dan nikmati keseruan serta peluang besar untuk meraih kemenangan yang menggiurkan. Semoga berhasil dan selamat bermain!

Bocoran RTP Live Slot Tertinggi

Pada kesempatan kali ini, kita akan membahas tentang bocoran RTP live slot tertinggi. RTP, atau Return to Player, adalah persentase kembaliannya dari total taruhan yang ditempatkan di mesin slot. Ini adalah faktor penting dalam menentukan peluang seorang pemain untuk memenangkan hadiah yang besar.

RTP live slot tertinggi adalah angka tertinggi yang dapat Anda harapkan dari sebuah mesin slot dalam jangka waktu tertentu. Mesin-mesin dengan RTP live slot tertinggi cenderung memberikan pembayaran yang lebih besar kepada para pemain, sehingga meningkatkan peluang untuk mendapatkan kemenangan yang menguntungkan.

Dalam mencari bocoran RTP live slot tertinggi, ada beberapa hal yang perlu diperhatikan. Pertama, lakukan riset tentang mesin slot yang memiliki reputasi bagus dalam memberikan tingkat pengembalian yang tinggi kepada para pemainnya. Kedua, pastikan untuk memahami aturan dan persyaratan dari mesin slot yang Anda pilih. Terakhir, tetapkan batasan untuk diri sendiri dalam bermain mesin slot dan jangan melebihi batas yang sudah ditetapkan.

Dengan memperhatikan hal-hal di atas, Anda dapat meningkatkan peluang Anda untuk mendapatkan bocoran tentang mesin slot dengan RTP live tertinggi. Ingatlah bahwa mesin slot dengan RTP tinggi tidak menjamin kemenangan, namun memiliki peluang yang lebih baik untuk memberikan pembayaran yang besar kepada para pemainnya.

Jadi, jangan ragu untuk mencari informasi tentang bocoran RTP live slot tertinggi agar Anda dapat meningkatkan peluang Anda dalam memenangkan hadiah besar di mesin slot. Tetap bijak dalam bermain dan selalu bermain dengan tanggung jawab. Semoga sukses!

Strategi Mengoptimalkan RTP Slot Gacor

Dalam mencari keuntungan dalam bermain RTP Slot, sangatlah penting untuk memiliki strategi yang tepat. Salah satu strategi yang bisa Anda terapkan adalah mengoptimalkan RTP Slot Gacor. Berikut adalah tiga tips yang dapat membantu Anda membuat RTP Slot Anda menjadi lebih gacor.

Pertama, pilihlah mesin slot dengan tingkat RTP yang tinggi. RTP, atau Return to Player, adalah persentase rata-rata dari total taruhan yang akan dikembalikan kepada pemain dalam jangka panjang. Dengan memilih mesin slot yang memiliki tingkat RTP yang tinggi, Anda memiliki peluang yang lebih baik untuk mendapatkan kemenangan yang lebih besar. Lakukan riset tentang mesin slot mana yang memiliki tingkat RTP terbaik dan mulailah bermain pada mesin tersebut.

Kedua, kelola dengan bijak modal Anda. Ketika bermain RTP Slot, penting bagi Anda untuk memiliki pengelolaan modal yang baik. Tetapkanlah batas harian, mingguan, atau bulanan pada seberapa banyak uang yang ingin Anda belanjakan dalam bermain slot. Jangan tergoda untuk memasang taruhan yang terlalu besar ketika sedang dalam keadaan kalah, karena hal ini bisa membuat modal Anda cepat habis. Jaga emosi dan tetap disiplin dalam mengelola modal Anda.

Terakhir, manfaatkan fitur bonus dan promo yang ditawarkan oleh situs slot online. Banyak situs slot online yang menawarkan berbagai jenis bonus dan promo kepada pemainnya. Manfaatkanlah kesempatan ini untuk meningkatkan peluang Anda dalam meraih kemenangan. Biasanya, bonus dan promo ini dapat memberikan tambahan kredit atau putaran gratis yang dapat digunakan dalam bermain slot. Pastikan untuk membaca syarat dan ketentuan yang berlaku, serta manfaatkan bonus dan promo dengan bijak.

Dengan menerapkan strategi yang tepat, Anda dapat mengoptimalkan RTP Slot Gacor dan meningkatkan peluang Anda dalam meraih kemenangan. Pilihlah mesin slot dengan tingkat RTP yang tinggi, kelola modal dengan bijak, dan manfaatkan bonus dan promo yang ditawarkan. Selamat bermain dan semoga sukses!